Hello, I’m Frank J. Garcia—a 50‑year‑old Registered Social Security Analyst (RSSA®) with over two decades dedicated to helping Americans navigate their retirement. One of the most critical decisions you’ll make is: When to claim Social Security. It’s more than just an age—it can mean tens of thousands of dollars over your lifetime.

Understanding claiming ages

- Age 62: You can begin benefits—but expect a ~30% reduction from your Primary Insurance Amount (PIA).

- Full Retirement Age (FRA): Around 66 to 67, depending on your birth year (e.g., FRA is 66+10 months for those born in 1959) .

- Age 70: Each year beyond FRA increases the benefit by about 8%, meaning a 24% hike if you wait until 70 .

Why delay can pay more

Although lifetime factors vary, delaying your claim increases monthly benefits significantly and benefits your survivor if you pass away first. Per recent data, a claim at 62 yields an average ~$2,831/month; at 70, benefits can reach up to ~$5,108/month.

Trends worth noting

Recent years have seen:

- A 13% bump in early claims, driven by concerns about Social Security’s sustainability .

- An upcoming COLA of 2.5% in 2025, raising average benefits from $1,927 to $1,976 per month .

- Fear of insolvency: Trustees estimate that by 2033–2035, benefits could take a ~20% cut .

How an RSSA® advisor helps

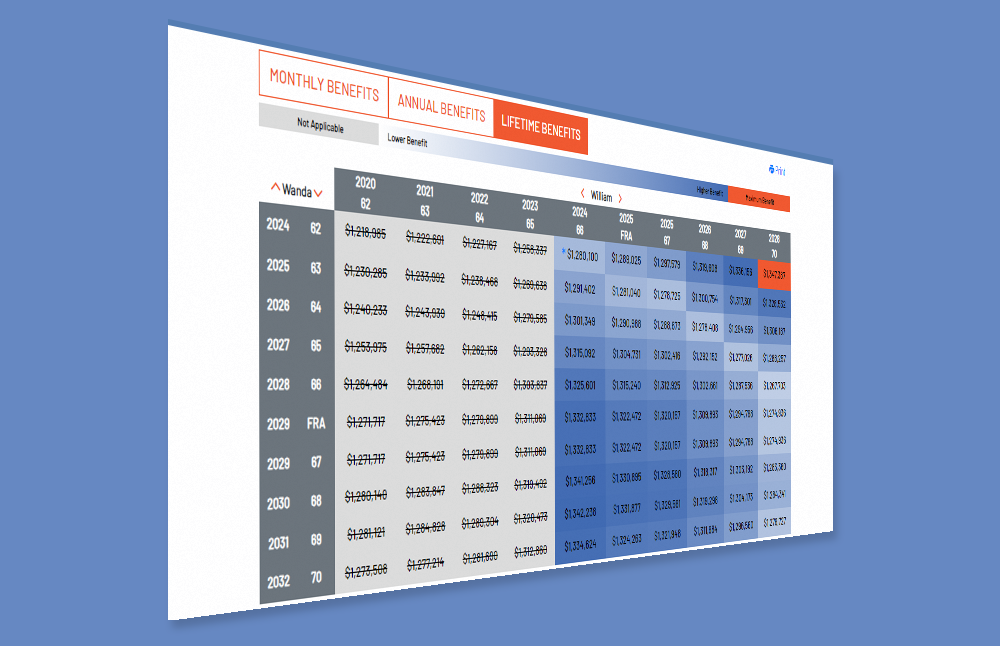

As your RSSA®, I’ll analyze your earnings, health, spouse’s benefits, and financial goals using proprietary tools like the Roadmap software to:

- Estimate accurate monthly benefits.

- Show outcomes for claiming at ages 62, FRA, or 70.

- Help you weigh trade-offs between higher immediate income vs. long-term gain.

Strategies to consider

- Bridge income: Use savings, part-time work, or annuities to delay Social Security.

- Spousal optimization: Married couples should coordinate claiming ages for maximum household lifetime income.

- Tax planning: Remember, up to 85% of your Social Security may be federally taxable depending on other income.

Final advice

Don’t let fear drive your decision. Social Security remains a strong, inflation-adjusted foundation—but you must claim strategically. As an experienced RSSA®, my job is to help you claim smart—today and tomorrow.